Home Improvements Loans Uk

Home Improvement Loans Nationwide

Fixed interest rates with a secured home improvement loan: your interest rate will be fixed with a secured home improvement loan, helping you to budget for your monthly repayments for the loan term choose your loan term: you can choose how long you want to be paying your loan back to help fix your monthly repayments at an amount that works for you. Borrow from £1,000 to £25,000. spread your repayments over 1 to 5 years for loans of £15,000 or less, or up to 8 years for loans over £15,000. 3. 3% apr* representative. for loans between £7,000 and £15,000. now also available to non-hsbc current account customers. *the rate is subject to change and the representative apr may not be the. You might find that a lender is prepared to let you borrow a higher loan amount for a secured loan than with an unsecured loan. some lenders offer £30,000 £100,000, depending on your credit history and financial situation. choosing between secured and unsecured loans. figuring out how much your home improvements are going to cost home improvements loans uk will help.

Home Improvement Loan House Renovations Hsbc Uk

Range of personal loans from £1,000 to £20,000, or £25,000 if you’re an existing santander customer; overpay at no extra cost; apply online and typically get a decision within 5 minutes. Home improvementloan features and benefits with a lloyds bank personal loan, you could receive a rate of 3. 9% apr representative apr stands for the annual percentage rate of charge. you can use it to compare different credit and loan offers. Homeimprovement is a popular reason for getting a personal loan and the range of products available reflects this. on 2 december, 2014, gocompare. com analysed 126 unsecured personal loans listed on the matrix of independent financial researcher defaqto and found that 83% of them could be used for home improvements.. the rate you pay will depend on your personal circumstances, the amount you.

How To Get A Zero Interest Home Remodeling Loan

Bad Credit Loans Bad Credit Payday Loans

Our home improvement loan allows you to borrow from £2,500 up to £25,000. repayment terms are between 2 years to 5 years. repayments will be monthly, with the first repayment being payable 1 month after you sign your agreement. you can make over-payments and early repayments on your loan free of charge, subject to our terms and conditions. Lightstream, a division of suntrust bank, for instance, is currently offering unsecured home improvement loans at 4. 99 percent apr for between $10,000 and $24,999; the loans last up to 36 months.

else wickes diy : wickes diy store a leading uk retailer of building and home-improvement supplies wilkinson plus : wilkinson plus is the online store and catalogue from wilkinson, the popular uk department store, offering furniture, house-hold goods and Our cheap personal loans guide details the cheapest personal loans best buys, but also addresses whether other finance options, like credit cards, might be cheaper for you. you can also use our handy loans eligibility calculator to find which unsecured loans you're most likely to be accepted for while protecting your credit score. A home improvement loan could help cover the cost of your project. whether it’s a new kitchen, bathroom or an extension, home improvements are a great way to change your living space to suit you better. loans are available to uk residents and over 18s only. rates will vary depending on loan amount and individual circumstances.

Top 10 Home Improvement Loans Money Co Uk

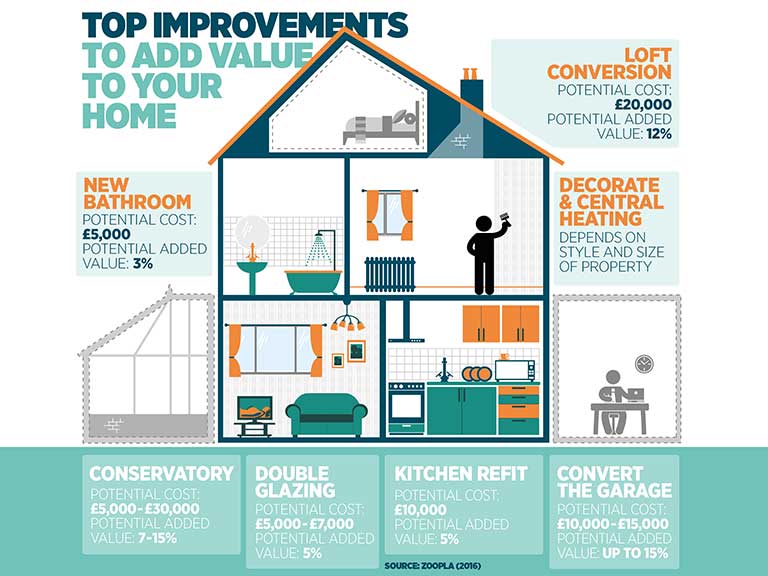

Home improvement loans can help add value to your property but you must get the cheapest deal to keep costs low. compare the best loans to help pay for your renovation here. choose the cheapest rate to get the best deal on your borrowing. A home improvement loan could give you the finance you need to make your house your own. we could help you to find the best loan to suit your needs. Remortgaging. you could consider remortgaging your home. a remortgage is the process of transferring your mortgage from one lender to another. for example, if you have £150,000 outstanding on your existing mortgage and you’d like £20,000 for home improvements, you may be able to find a mortgage lender willing to lend you £170,000. Home improvement loans can help add value to your property but you must get the cheapest deal to keep costs low. compare the best loans to help pay for your renovation here. choose the cheapest rate to get the best deal on your borrowing.

A home-improvement loan may not be the best option for older borrowers because this will cause them to be in debt in retirement. with equity release, you will never owe home improvements loans uk more than the value of your. Representative example. you could borrow £10,000 over 48 months with 48 monthly repayments of £223. 32. total amount repayable will be £10,719. 36. representative 3. 5% apr, annual interest rate (fixed) 3. 45%.. this representative apr applies to loans of £7,500 to £25,000 over 1 to 5 years. loans find a loan loan calculator hm forces loans home improvements about credit cards uk money terms and slang more info what is passive income ? redundancy saving money how to sell home work in india ideas business loan calculator writing a business plan make money with

Range of personal loans from £1,000 to £20,000, or £25,000 if you’re an existing santander customer. overpay at no extra cost. apply online and typically get a decision within 5 minutes. you’re 21 or over and live in the uk permanently. you have a regular yearly income of £6,000+ you make your repayments by direct debit. A home improvement loan allows you to borrow a set amount in order to fund home renovations or other projects to your property. these typically come in the form of an unsecured personal loan, but you can also secure the loan against your home, which normally allows you to borrow larger amounts.

The most popular way to finance a large home improvement project is with a home equity loan or line of credit or with an fha 203(k) loan. the most popular way to finance smaller projects is with. Once you have a clear idea of how much your home improvements will cost, you can use our calculator to see if a personal loan is the home improvements loans uk right finance option for your needs. apply for a loan to apply for a lloyds bank loan, you must be over 18 years old and a uk resident. Bad credit ok. apply in 60 seconds. helps people to get approved for their bad credit loans! quick easy guaranteed cash advance online. same day short terms loans unsecured, no credit check and instant approval. Nationwide home improvement loans cash into your nationwide current account in just two hours from just 2. 9% apr representative (fixed) on unsecured loans from £7,500 £25,000 over 1 to 5 years for our members with a mortgage, savings or main current account.

Your home is an investment, and home improvement loans can offer the funding you need to strengthen that investment with renovations, updates and repairs. however, there are risks involved, and not all home improvement loans are the same. this guide covers the types of home improvement loans available, the costs of a home improvement loan, how. Nationwide home improvement loans cash into your nationwide current account in just two hours from just 2. 9% apr representative (fixed) on unsecured loans from £7,500 £25,000 over 1 to 5 years for our members with a mortgage, savings or main current account 2. 9 % apr.

Home improvement loans gocompare. com.

Komentar

Posting Komentar